Simple interest is calculated using the principal only, ignoring any interest accrued in preceding interest periods. The total simple interest over several periods is computed as

where I is the amount of interest earned or paid and the interest rate i is expressed in decimal form.

EXAMPLE 1.14

GreenTree Financing lent an engineering company $100,000 to retrofi t an environmentally unfriendly building. The loan is for 3 years at 10% per year simple interest. How much money will the firm repay at the end of 3 years?

Solution

The interest accrued in the first year and in the second year does not earn interest. The interest due each year is $10,000 calculated only on the $100,000 loan principal.

In most financial and economic analyses, we use compound interest calculations.

For compound interest, the interest accrued for each interest period is calculated on the principal plus the total amount of interest accumulated in all previous periods. Thus, compound interest means interest on top of interest.

Compound interest reflects the effect of the time value of money on the interest also. Now the interest for one period is calculated as

In mathematical terms, the interest It for time period t may be calculated using the relation.

EXAMPLE 1.15

Assume an engineering company borrows $100,000 at 10% per year compound interest and will pay the principal and all the interest after 3 years. Compute the annual interest and total amount due after 3 years. Graph the interest and total owed for each year, and compare with the previous example that involved simple interest.

Solution

To include compounding of interest, the annual interest and total owed each year are calculated by Equation [1.8].

The repayment plan requires no payment until year 3 when all interest and the principal, a total of $133,100, are due. Figure 1–11 uses a cash flow diagram format to compare end-of-year (a) simple and (b) compound interest and total amounts owed. The differences due to com- pounding are clear. An extra $133,100 – 130,000 = $3100 in interest is due for the compounded interest loan.

Note that while simple interest due each year is constant, the compounded interest due grows geometrically. Due to this geometric growth of compound interest, the difference between simple and compound interest accumulation increases rapidly as the time frame increases. For example, if the loan is for 10 years, not 3, the extra paid for compounding interest may be calculated to be $59,374.

|

| Figure 1–11 Interest I owed and total amount owed for ( a ) simple interest (Example 1.14) and ( b ) compound interest (Example 1.15). |

This allows future totals owed to be calculated directly without intermediate steps. The general form of the equation is

where i is expressed in decimal form. Equation [1.10] was applied above to obtain the $133,100 due after 3 years. This fundamental relation will be used many times in the upcoming chapters.

We can combine the concepts of interest rate, compound interest, and equivalence to demon- strate that different loan repayment plans may be equivalent, but differ substantially in amounts paid from one year to another and in the total repayment amount. This also shows that there are many ways to take into account the time value of money.

EXAMPLE 1.16

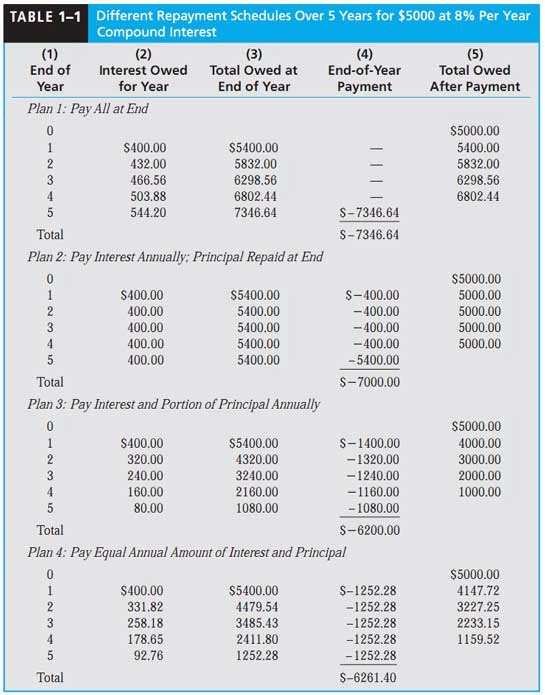

Table 1–1 details four different loan repayment plans described below. Each plan repays a $5000 loan in 5 years at 8% per year compound interest.

• Plan 1: Pay all at end. No interest or principal is paid until the end of year 5. Interest accumulates each year on the total of principal and all accrued interest.

• Plan 2: Pay interest annually, principal repaid at end. The accrued interest is paid each year, and the entire principal is repaid at the end of year 5.

• Plan 3: Pay interest and portion of principal annually. The accrued interest and one-fi fth of the principal (or $1000) are repaid each year. The outstanding loan balance decreases each year, so the interest (column 2) for each year decreases.

• Plan 4: Pay equal amount of interest and principal. Equal payments are made each year with a portion going toward principal repayment and the remainder covering the accrued interest. Since the loan balance decreases at a rate slower than that in plan 3 due to the equal end-of-year payments, the interest decreases, but at a slower rate.

(a) Make a statement about the equivalence of each plan at 8% compound interest.

(b) Develop an 8% per year simple interest repayment plan for this loan using the same approach as plan 2. Comment on the total amounts repaid for the two plans.

Solution

(a) The amounts of the annual payments are different for each repayment schedule, and the total amounts repaid for most plans are different, even though each repayment plan requires exactly 5 years. The difference in the total amounts repaid can be ex- plained by the time value of money and by the partial repayment of principal prior to year 5.

A loan of $5000 at time 0 made at 8% per year compound interest is equivalent to each of the following:

Plan 1 $7346.64 at the end of year 5

Plan 2 $400 per year for 4 years and $5400 at the end of year 5

Plan 3 Decreasing payments of interest and partial principal in years 1 ($1400) through 5 ($1080)

Plan 4 $1252.28 per year for 5 years

An engineering economy study typically uses plan 4; interest is compounded, and a constant amount is paid each period. This amount covers accrued interest and a partial amount of principal repayment.

(b) The repayment schedule for 8% per year simple interest is detailed in Table 1–2. Since the annual accrued interest of $400 is paid each year and the principal of $5000 is repaid in year 5, the schedule is exactly the same as that for 8% per year compound interest, and the total amount repaid is the same at $7000. In this unusual case, simple and compound interest result in the same total repayment amount. Any deviation from this schedule will cause the two plans and amounts to differ.

ReplyDelete"Greetings to You,

2% LOAN OFFER, We are Certified to Offer the following Kinds Of Loans * Personal Loan(Unsecured) * Business loan (Unsecured) * Debt Consolidation Loan *Improve your home * Investment Loan. We are privilege to meet your financial needs. The issue of credit shouldn't stop you from getting the loan that you need. we can finance up to the amount $10,000 to $100,000,000 in any region of the world as long as our 2% ROI can be guaranteed on the projects.If you are interested, please contact us today E-mail: nodebtloan@gmail.com with the following information below:

Full Name:

Employment status:

Amount of Loan requested:

Country:

Best Regard

Yours In Service,

MEGG Funding Management.

Need a Debt Loan To Pay Off Bills?

ReplyDeleteTake control of your debt today

Available Now Business Expansion Loan Offer?

Do you need a loan to pay off Bills?

Do you need a loan?

Do you need Personal Loan?

Business Expansion Loan?

Business Start-up, Education,

Debt Consolidation Loan

Hard Money Loans

Loan for any thing ?

We offer loan at low interest rate of 3%

Loan with no credit check,

Email us: financialserviceoffer876@gmail.com

Call or add us on what's app +918929509036

WhatsApp. http://wa.me/17077013848

ReplyDeleteGet (IELTS, OET, PTE , GRE,NCLEX And TOEFL)

-we update and modify your poorly performed scores directly from the system

-we can control and change your scores from the the system while you attend the exam

-we also provide leak questions and answers for upcoming exams

-Provide certificate with online verification on the official website.

We are a network of English Language Professors with years of Examination experience. During these years, we have been able to derive backdoor means of registering IELTS certificates without Students taking the Test. With our help, you can be able to get real registered and original IELTS Certificates without facing the stress and trauma of the Exam. The IELTS Certificates we issue carries a score of your choosing and you will be able to verify it online and collect the original TRF or Test report card from local district Examination Center or we send it directly to you contact us using the details below and know more about the process

WhatsApp:+1(707)701-3848

Email: buyrealdocumentshome@gmail.com

BUY READY BLANK ATM CARD, READY TO HIT ANY ATM MACHINE WITHOUT ANY PIN CODE, WITH A MAXIMUM WITHDRAWAL OF $5.000.00 PER DAY AND A LIFE SPAN OF 4WEEKS(28days) OPERATIONAL.

Credit Card Hack Software

Need a Debt Loan To Pay Off Bills?

Take control of your debt today

Available Now Business Expansion Loan Offer?

Do you need a loan to pay off Bills?

Do you need a loan?

Do you need Personal Loan?

Business Expansion Loan?

Business Start-up, Education,

Debt Consolidation Loan

Hard Money Loans

Loan for any thing ?

We offer loan at low interest rate of 3%

WhatsApp:+1(707)701-3848

Email: buyrealdocumentshome@gmail.com

-Undetected Fake bank statement for loan

-fake bank statement / Real Verify Bank Statement

-Clear your criminal record from any Country database system

-Hack any phone from a distance without physical contact.

-Increase your credit score to your desired amount

-Buy fake drivers license, I’d, ssn, Passport

-Buy clone credit card ready to hit any atm machine, gift card amazon card, etc Fake bank statement for loan

-Hack any online banking account, PayPal account, bitcoin, flight tickets

-Buy any school certificate, diploma, degree all registered under the database system

-Fake bank account/verified bank account with login details for a loan

— Our bank articulation is utilised to demonstrate your loan specialists or customers you possess the accurate offset on the announcement with a 6months exchange notable that can be checked through any strategy for their decision, yet you can't move or pull back any cash from this record, for more details visit our website of Fake bank statement for loan

WhatsApp:+1(707)701-3848

Email: buyrealdocumentshome@gmail.com

Texas drivers license replacement, lost drivers license texas, lost texas drivers license, replace texas drivers license, how to get a drivers license in texas, texas drivers license template, oklahoma drivers license, colorado drivers license, kansas drivers license, drivers license utah, fake drivers license, ny drivers license document number, idaho drivers license renewal, florida birth certificate, oklahoma birth certificate, illinois birth certificate, oregon birth certificate, maryland birth certificate, birth certificate michigan, arizona birth certificate, new jersey birth certificate, idaho birth certificate,Fake bank statement for loan, los angeles county birth certificate, birth certificate virginia, wisconsin birth certificate, mississippi birth certificate, fake birth certificate

WhatsApp:+1(707)701-3848

Email: buyrealdocumentshome@gmail.com